Introduction

Welcome, code wizards, to the wild world of Crypto 2025! As blockchains scale, DeFi redefines the financial universe, and legal landscapes shift, we’re rolling out the ultimate guide for developers who want a front-row seat to crypto hilarity. Whether it’s tackling Layer 2 whizbangs or navigating mind-bending laws, prepare for a ride filled with humor and insights.

Tables of Contents

Chapter 1: Economic and Regulatory Shifts in Xu hướng crypto năm 2025

- Strategic Positioning: Institutional Investment Trends Shaping Crypto in 2025

- Navigating Regulatory Tides: Crypto Landscape Transformation in 2025

Chapter 2: Technological Innovations in Xu hướng crypto năm 2025

- Revolutionizing Blockchain: Scalability Enhancements for 2025

- Decentralized Finance: Transforming Traditional Financial Boundaries by 2025

Chapter 1: Economic and Regulatory Shifts in Xu hướng crypto năm 2025

1. Strategic Positioning: Institutional Investment Trends Shaping Crypto in 2025

In 2025, institutional investors are strategically gravitating towards Bitcoin and Ethereum, with roughly 67% of their crypto holdings focused on these established assets. This preference signals a desire for stability amid a volatile market. Notably, over-the-counter trading volumes have soared, reflecting the institutional need for discretion. Institutional capital influx has propelled Bitcoin to previously unimaginable heights, fueled by the adoption of Bitcoin ETFs. These financial products facilitate easy access to the crypto market for traditional investors, bolstering market liquidity. Institutions are also embracing tokenization, seen in initiatives like BlackRock’s tokenized fund, enhancing portfolio diversification and bridging traditional finance with blockchain. Regulatory clarity and technological advances, such as Ethereum Layer-2 solutions, are likely to continue shaping these trends. For more insights on Ethereum’s evolution, see Ethereum Ecosystem 2025.

2. Navigating Regulatory Tides: Crypto Landscape Transformation in 2025

In 2025, the regulatory environment in the U.S. is radically altering the crypto industry with landmark legislation such as the CLARITY Act, the GENIUS Act, and the Anti-CBDC Act. These acts are pivotal in setting new standards for digital assets, aiming to distinguish clearly between securities and commodities, thereby facilitating a robust framework for institutional investors. This progression under the CLARITY Act encourages entities like BlackRock and Fidelity to delve deeper into crypto markets, potentially launching Bitcoin ETFs, spurring capital inflow. Concurrently, the GENIUS Act sets stablecoin regulations, essential for market stability. Enhanced consumer protections now demand stricter compliance akin to conventional finance, fostering a safer investment atmosphere. For thorough insights, visit here.

Chapter 2: Technological Innovations in Xu hướng crypto năm 2025

1. Revolutionizing Blockchain: Scalability Enhancements for 2025

In 2025, the pivotal advancements in blockchain scalability are largely driven by innovative Layer 2 (L2) solutions. For Bitcoin, methods like rollups—encompassing ZK-Rollups and Optimistic Rollups—enhance throughput while cutting costs, elevating transaction speeds to thousands per second. Ethereum also sees transformation as zero-knowledge proof technology is incorporated into its Layer 1, boosting scalability and privacy via a native zkEVM. Additionally, modular blockchain architectures, exemplified by Celestia and Polygon 2.0, provide frameworks for efficient network specialization. As developers aim for secure scalability, the continued evolution of Ethereum’s ecosystem is of notable interest (see more here). More insights are available here.

2. Decentralized Finance: Transforming Traditional Financial Boundaries by 2025

By 2025, Decentralized Finance (DeFi) has revolutionized the financial ecosystem, transcending beyond niche applications to become a cornerstone of global finance. Key innovations like Real-World Asset (RWA) Tokenization integrate tangible assets—such as real estate and bonds—into DeFi platforms, enhancing liquidity and transparency while allowing fractional ownership. DeFi 3.0 ushers in permissionless lending and optimized capital use, accommodating a diverse range of participants. The lending sector thrives, with total value locked reaching $55 billion, spearheaded by platforms like Aave. Furthermore, decentralized derivatives exchanges showcase DeFi’s scalability, preparing for mainstream adoption. These developments indicate a dynamic shift towards more inclusive financial services, echoing a global movement towards decentralized digital economies.

Final thoughts

And there you have it! In the rollicking universe of 2025, developers will be the unsung heroes steering the blockchain behemoth amidst innovations and regulations. As you navigate this whimsical landscape, keep one eye on your code and the other on absurd legal antics!

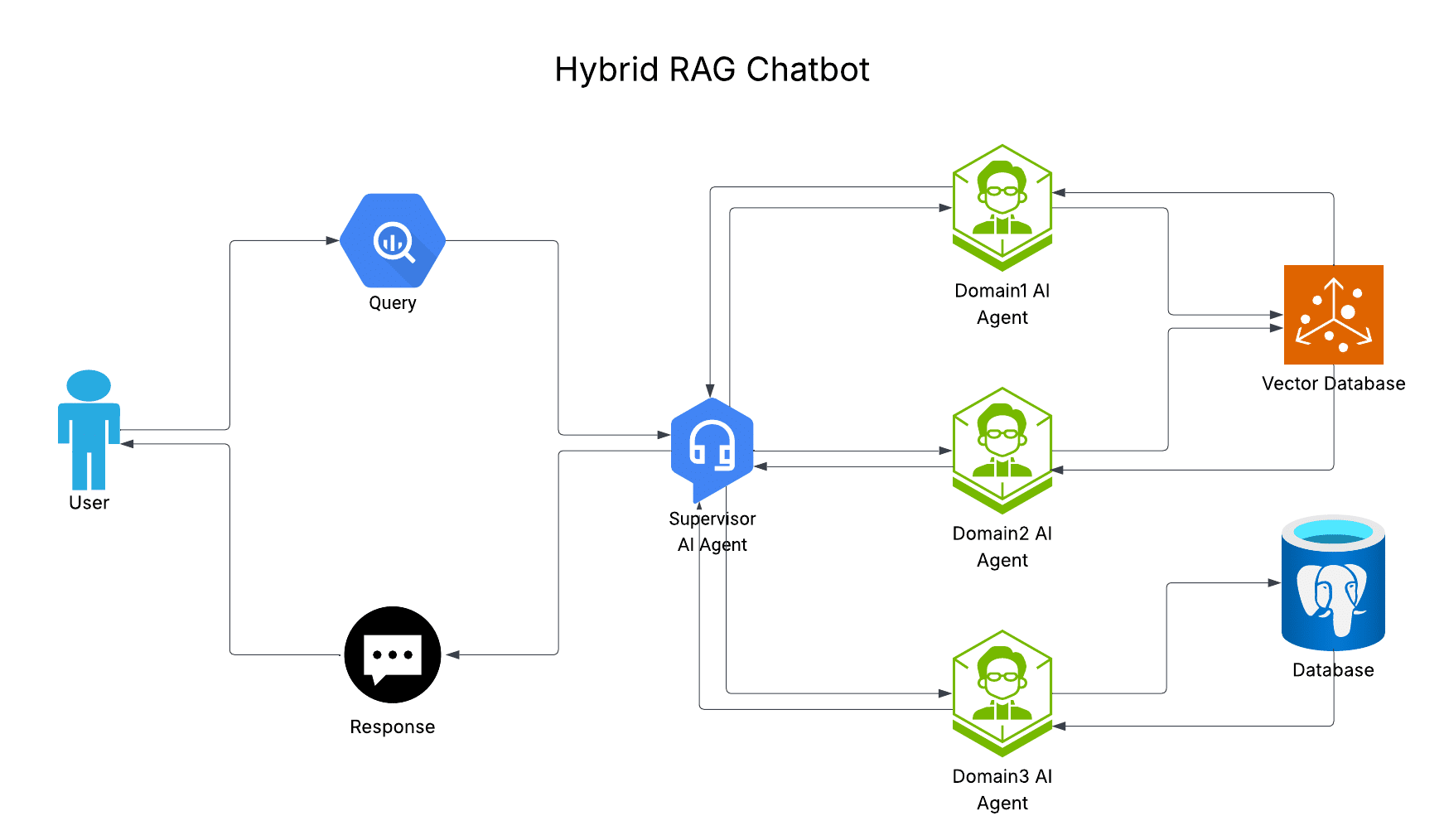

Ready to elevate your business with cutting-edge automation? Contact AI Automation Pro Agency today and let our expert team guide you to streamlined success with n8n and AI-driven solutions!

About us

AI Automation Pro Agency is a forward-thinking consulting firm specializing in n8n workflow automation and AI-driven solutions. Our team of experts is dedicated to empowering businesses by streamlining processes, reducing operational inefficiencies, and accelerating digital transformation. By leveraging the flexibility of the open-source n8n platform alongside advanced AI technologies, we deliver tailored strategies that drive innovation and unlock new growth opportunities. Whether you’re looking to automate routine tasks or integrate complex systems, AI Automation Pro Agency provides the expert guidance you need to stay ahead in today’s rapidly evolving digital landscape.